Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility

Related Articles: Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility

- 2 Introduction

- 3 Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility

- 4 Closure

Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility

![Health Savings Accounts [Infographic] ~ Visualistan](https://3.bp.blogspot.com/-DjvkpyGAmZU/UvoCRPpM6lI/AAAAAAAAKXI/OkWOP5yPAL0/s1600/Health-Savings-Accounts-Infographic.png)

The Health Savings Account (HSA) offers a valuable tax advantage for individuals enrolled in high-deductible health plans. This account allows individuals to contribute pre-tax dollars to cover qualified medical expenses, including over-the-counter (OTC) medications. However, determining which OTC medications are eligible for HSA reimbursement can be a challenging task, particularly when considering products like lotions. This article aims to clarify the intricacies of HSA eligibility for lotions, providing a comprehensive guide for navigating this complex area.

Understanding HSA Eligibility for OTC Medications:

The Internal Revenue Service (IRS) defines qualified medical expenses for HSA purposes as those incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body. This broad definition encompasses a wide range of healthcare products and services, including OTC medications.

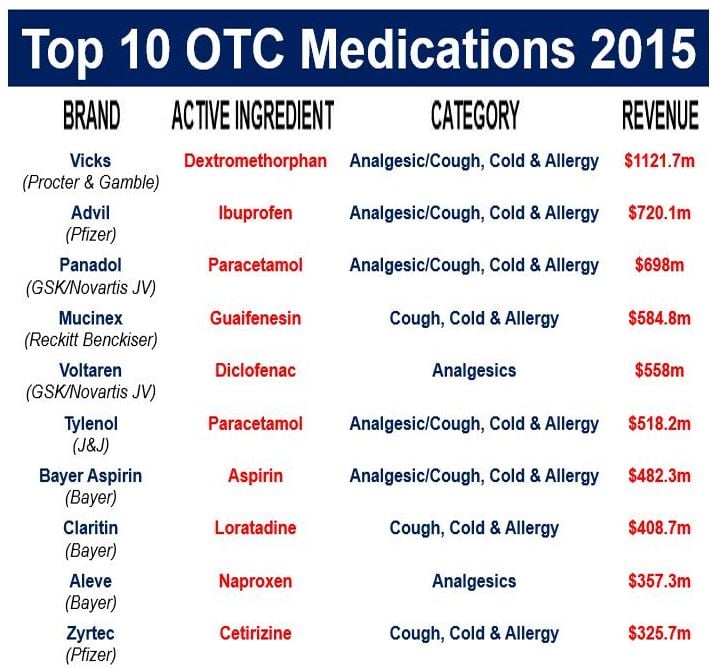

However, the eligibility of specific OTC medications, including lotions, hinges on the intended use and the active ingredients. While lotions may be used for various purposes, including skincare, pain relief, and insect repellent, only those intended for medical purposes and containing qualifying active ingredients are HSA-eligible.

Lotions and HSA Eligibility: A Case-by-Case Analysis:

The determination of HSA eligibility for lotions requires a careful examination of the product label and its intended use. Here’s a breakdown of common lotion types and their potential eligibility:

- Lotions for Skin Conditions: Lotions intended for the treatment of specific skin conditions, such as eczema, psoriasis, or acne, are generally HSA-eligible. These products often contain active ingredients approved by the Food and Drug Administration (FDA) for treating these conditions, such as hydrocortisone, salicylic acid, or benzoyl peroxide.

- Lotions for Pain Relief: Lotions containing pain-relieving ingredients, such as menthol, camphor, or capsaicin, are often eligible for HSA reimbursement. These products are typically used for temporary relief of muscle aches, joint pain, or arthritis pain.

- Lotions for Insect Repellents: Lotions designed to repel insects, containing active ingredients like DEET or picaridin, are generally considered HSA-eligible, as they serve a medical purpose by preventing insect bites and associated diseases.

- Moisturizing Lotions: While basic moisturizing lotions without active ingredients may not qualify for HSA reimbursement, there are exceptions. Some moisturizing lotions contain specific ingredients, such as hyaluronic acid or ceramides, which are intended to treat dry skin conditions. In these cases, HSA eligibility may be considered.

Navigating the Grey Areas:

The line between HSA-eligible and ineligible lotions can be blurred, especially for products with multiple intended uses. For instance, a lotion marketed as both a moisturizer and a sun protectant may fall into a grey area. In such cases, it is advisable to consult with a healthcare professional or a qualified tax advisor to determine the appropriate course of action.

Tips for Determining HSA Eligibility:

- Consult the Product Label: Carefully examine the product label for information about its intended use and active ingredients.

- Review the IRS Publication 502: The IRS Publication 502, "Medical Expenses," provides detailed guidance on qualified medical expenses for HSA purposes.

- Seek Professional Advice: If you are unsure about the HSA eligibility of a specific lotion, consult with a healthcare professional or a qualified tax advisor.

Frequently Asked Questions:

Q: Can I claim HSA reimbursement for lotions purchased for general skincare purposes?

A: Generally, lotions purchased for general skincare purposes, such as moisturizing or smoothing the skin, are not considered HSA-eligible. However, lotions containing specific ingredients for treating medical conditions, such as eczema or psoriasis, may qualify.

Q: Do I need a doctor’s prescription for lotions to be HSA-eligible?

A: A doctor’s prescription is not always required for OTC medications to be HSA-eligible. However, obtaining a prescription can provide documentation supporting the medical purpose of the purchase.

Q: Can I claim HSA reimbursement for lotions purchased online?

A: Yes, you can claim HSA reimbursement for lotions purchased online, as long as they meet the HSA eligibility criteria and you have appropriate documentation, such as receipts or invoices.

Q: What if the lotion I purchased is not specifically labeled as "medicinal"?

A: The absence of the word "medicinal" on the product label does not automatically disqualify a lotion from HSA eligibility. The key factor is the intended use and the presence of active ingredients that address a medical condition.

Conclusion:

Navigating the complexities of HSA eligibility for lotions requires careful consideration of the product’s intended use, active ingredients, and the IRS guidelines. While not all lotions qualify for HSA reimbursement, those specifically intended for medical purposes, containing FDA-approved active ingredients, and addressing specific conditions, are generally eligible. By following the tips and seeking professional advice when needed, individuals can maximize the benefits of their HSA while ensuring compliance with IRS regulations. Remember, staying informed and seeking clarification are essential for making informed decisions about your HSA benefits.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Over-the-Counter Medications and Health Savings Accounts: A Guide to Understanding Lotion Eligibility. We hope you find this article informative and beneficial. See you in our next article!