Navigating the IRS Business Codes for Skin Care: A Comprehensive Guide

Related Articles: Navigating the IRS Business Codes for Skin Care: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the IRS Business Codes for Skin Care: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the IRS Business Codes for Skin Care: A Comprehensive Guide

The world of skincare is a vibrant and ever-evolving industry, with businesses ranging from small home-based operations to sprawling international corporations. As with any business endeavor, understanding the intricacies of tax regulations is paramount for success and compliance. This guide delves into the specific IRS business codes applicable to skincare businesses, offering a clear and comprehensive explanation of their significance and practical application.

Understanding the North American Industry Classification System (NAICS)

The foundation of IRS business codes lies within the North American Industry Classification System (NAICS). This standardized system categorizes businesses based on their primary activities, providing a framework for data collection, analysis, and reporting. Each NAICS code is a six-digit number, with the first two digits representing the broad industry sector, followed by increasingly specific sub-sectors.

Skin Care Businesses and Their Corresponding NAICS Codes

For skincare businesses, the primary NAICS code falls under Sector 32: Manufacturing, specifically 325620: Personal Care Product Manufacturing. This code encompasses the production of a wide array of personal care items, including:

- Skin care products: This category includes lotions, creams, cleansers, toners, masks, serums, sunscreens, and other topical treatments designed for skin health and beauty.

- Hair care products: Shampoos, conditioners, hair dyes, styling products, and hair treatments fall under this category.

- Fragrances and perfumes: This category includes a diverse range of scents designed for personal use.

- Soaps and detergents: This category includes bar soaps, liquid soaps, and other cleaning products used for personal hygiene.

Specific NAICS Codes for Skin Care Businesses

Within the broader category of 325620: Personal Care Product Manufacturing, further specialization exists for specific types of skin care businesses:

- 32562000: Personal Care Product Manufacturing – This code encompasses the production of all types of personal care products, including skin care, hair care, fragrances, and soaps.

- 32562001: Skin Care Product Manufacturing – This code specifically focuses on the production of skin care products, such as lotions, creams, cleansers, and serums.

- 32562002: Hair Care Product Manufacturing – This code focuses on the production of hair care products, such as shampoos, conditioners, and styling products.

- 32562003: Fragrance and Perfume Manufacturing – This code encompasses the production of perfumes, colognes, and other scented products.

- 32562004: Soap and Detergent Manufacturing – This code focuses on the production of soaps, detergents, and other cleaning products used for personal hygiene.

Importance of the Correct NAICS Code

The accurate selection of a NAICS code is crucial for a variety of reasons:

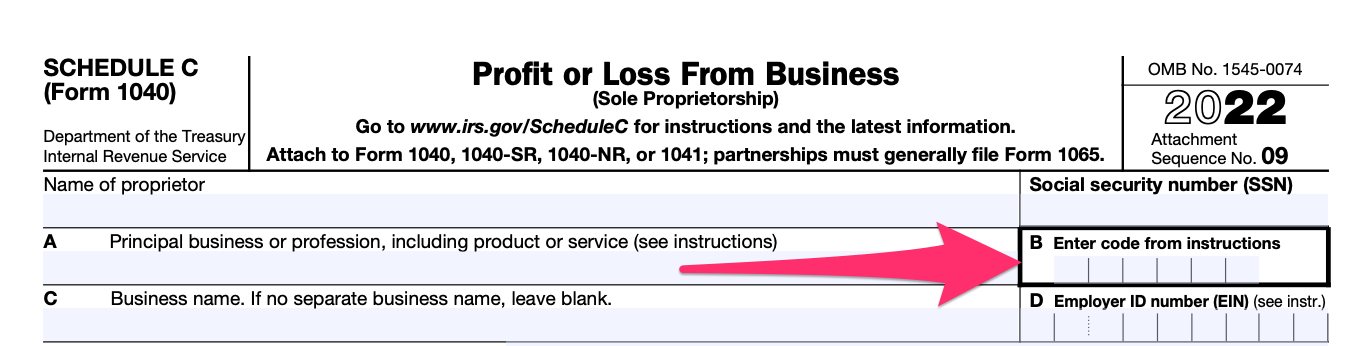

- Tax Filing and Reporting: The IRS uses NAICS codes to categorize businesses for tax purposes. This code determines the specific forms and schedules required for filing income tax returns, as well as the applicable tax rates and deductions.

- Business Loans and Grants: Lenders and grant providers often use NAICS codes to assess the eligibility and risk associated with specific businesses. A correct NAICS code can enhance the chances of securing funding.

- Industry Statistics and Analysis: The NAICS code provides a standardized framework for collecting and analyzing data on various industries, enabling businesses to benchmark their performance against industry averages.

- Government Regulations and Licensing: Certain industries may require specific licenses or permits based on their NAICS code. This ensures compliance with relevant regulations and safety standards.

Benefits of Understanding NAICS Codes for Skin Care Businesses

By understanding the specific NAICS codes applicable to their business, skincare entrepreneurs can:

- Optimize tax compliance: Ensure accurate tax filing and reporting, potentially minimizing tax liabilities and avoiding penalties.

- Access relevant funding opportunities: Increase the likelihood of securing loans and grants specifically designed for their industry.

- Gain valuable industry insights: Utilize data and analysis to improve business strategies and make informed decisions.

- Navigate regulatory requirements: Ensure compliance with all applicable licenses and permits, avoiding legal issues and potential fines.

FAQs: IRS Business Codes for Skin Care

1. What if my skincare business involves multiple activities, such as manufacturing, retail, and online sales?

In such cases, you should choose the NAICS code that best reflects your primary activity. You may also need to obtain additional codes for secondary activities, depending on the specific nature of your business.

2. How do I determine the correct NAICS code for my skincare business?

The IRS provides online tools and resources to help businesses identify their appropriate NAICS code. The official NAICS website offers a search function based on industry descriptions, allowing you to find the most relevant code for your specific business activities.

3. Can I change my NAICS code after I have already filed my tax return?

Yes, you can amend your tax return to reflect a change in your business activities or NAICS code. However, it is crucial to consult with a tax professional to ensure the proper procedures are followed and potential penalties are avoided.

4. Do I need to obtain a separate NAICS code for each product line within my skincare business?

Generally, a single NAICS code is sufficient for a business, even if it offers multiple product lines. However, if a particular product line represents a significant portion of your business revenue or involves a distinct manufacturing process, you may consider obtaining a separate NAICS code.

5. What are the consequences of using an incorrect NAICS code?

Using an incorrect NAICS code can lead to several issues, including:

- Incorrect tax reporting: This can result in underpayment or overpayment of taxes, potentially leading to penalties and audits.

- Ineligibility for certain programs: Some government programs and funding opportunities are restricted to businesses within specific NAICS codes.

- Misleading industry data: Incorrect codes can distort industry statistics and hinder accurate analysis of market trends.

Tips for Skin Care Businesses: IRS Business Codes

- Consult a tax professional: Seek guidance from a qualified tax professional to ensure the accurate selection and application of NAICS codes.

- Stay updated on NAICS revisions: The NAICS system is periodically revised to reflect changes in the economy. Stay informed about any updates that may affect your business.

- Maintain accurate records: Keep detailed records of your business activities to support the NAICS code you choose.

- Document any changes: If your business activities or product offerings change, update your NAICS code accordingly and document the reason for the change.

Conclusion

Understanding the IRS business codes specific to skincare businesses is essential for navigating tax regulations, accessing funding opportunities, and gaining valuable industry insights. By diligently selecting the appropriate NAICS code, skincare entrepreneurs can ensure compliance, optimize their business operations, and foster sustainable growth within this dynamic industry. Remember, seeking guidance from a tax professional is crucial to ensure accurate code selection and avoid potential pitfalls.

Closure

Thus, we hope this article has provided valuable insights into Navigating the IRS Business Codes for Skin Care: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!