Navigating the Landscape of HSA-Eligible Healthcare Products: A Comprehensive Guide

Related Articles: Navigating the Landscape of HSA-Eligible Healthcare Products: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of HSA-Eligible Healthcare Products: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of HSA-Eligible Healthcare Products: A Comprehensive Guide

The Health Savings Account (HSA) offers a valuable tax-advantaged way to save for healthcare expenses. However, not all healthcare products are eligible for HSA reimbursement. Understanding the specific products and services that qualify can be crucial for maximizing the benefits of your HSA. This comprehensive guide delves into the nuances of HSA-eligible healthcare products, offering insights into their importance, benefits, and considerations for effective utilization.

Understanding the HSA Landscape:

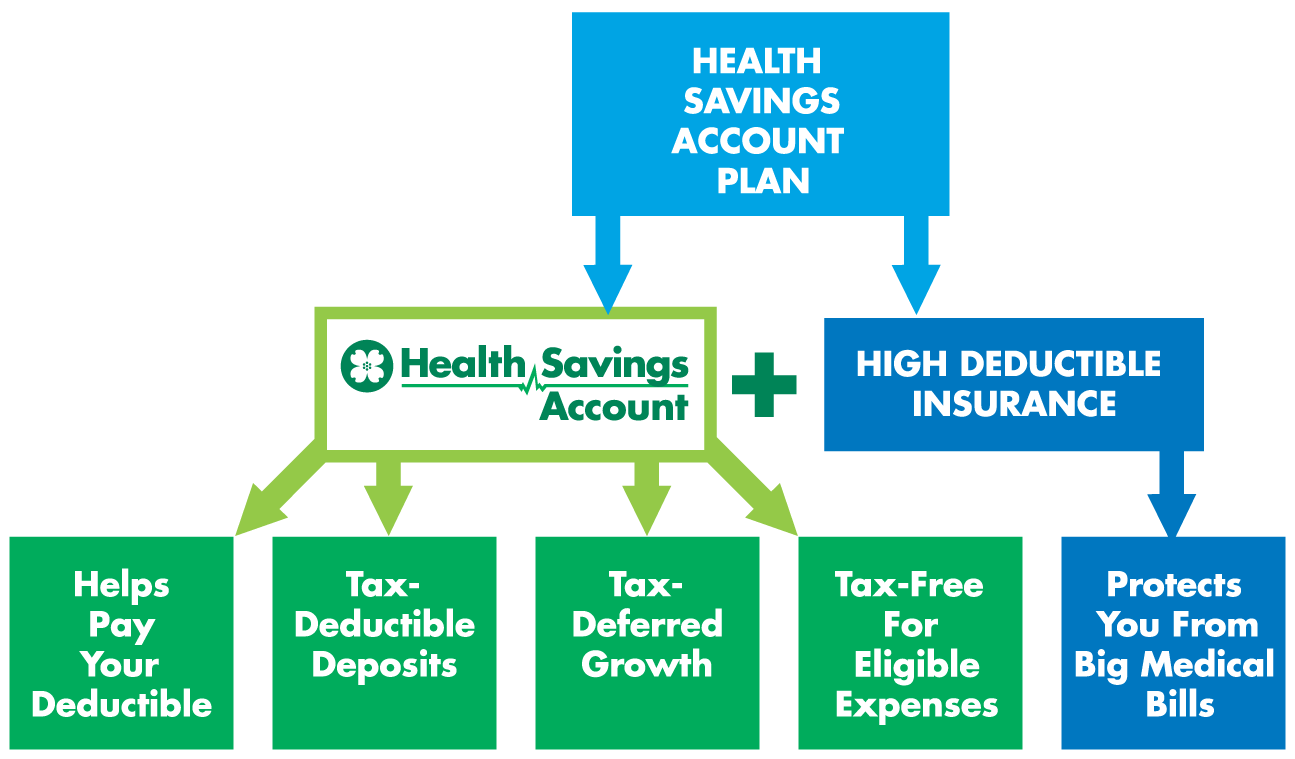

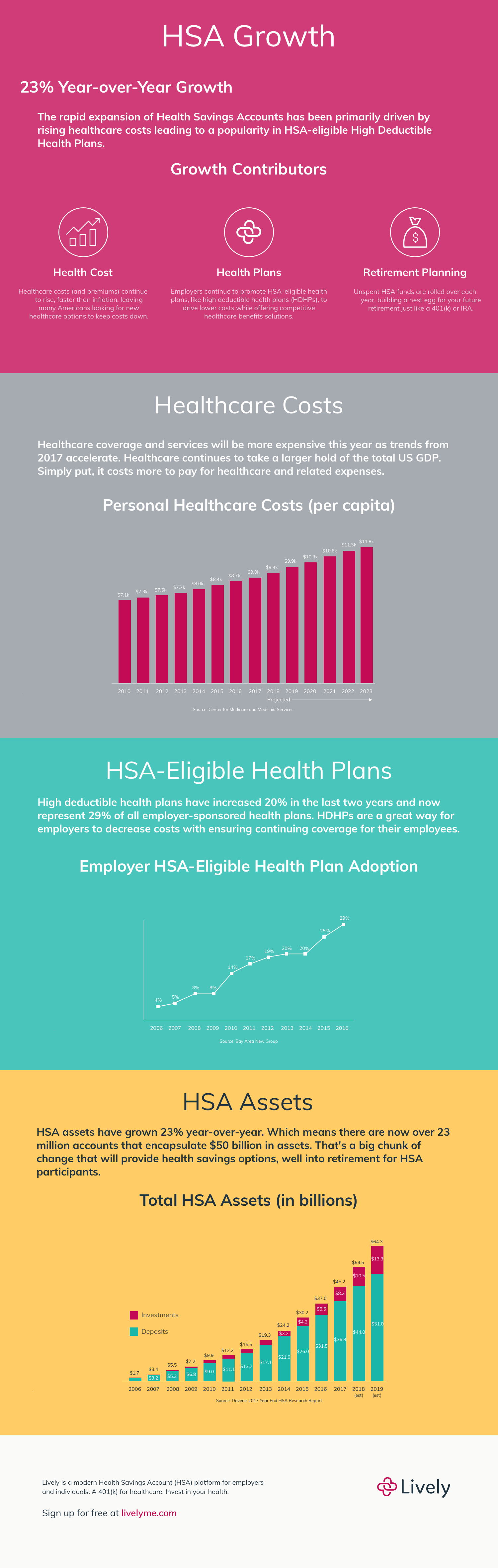

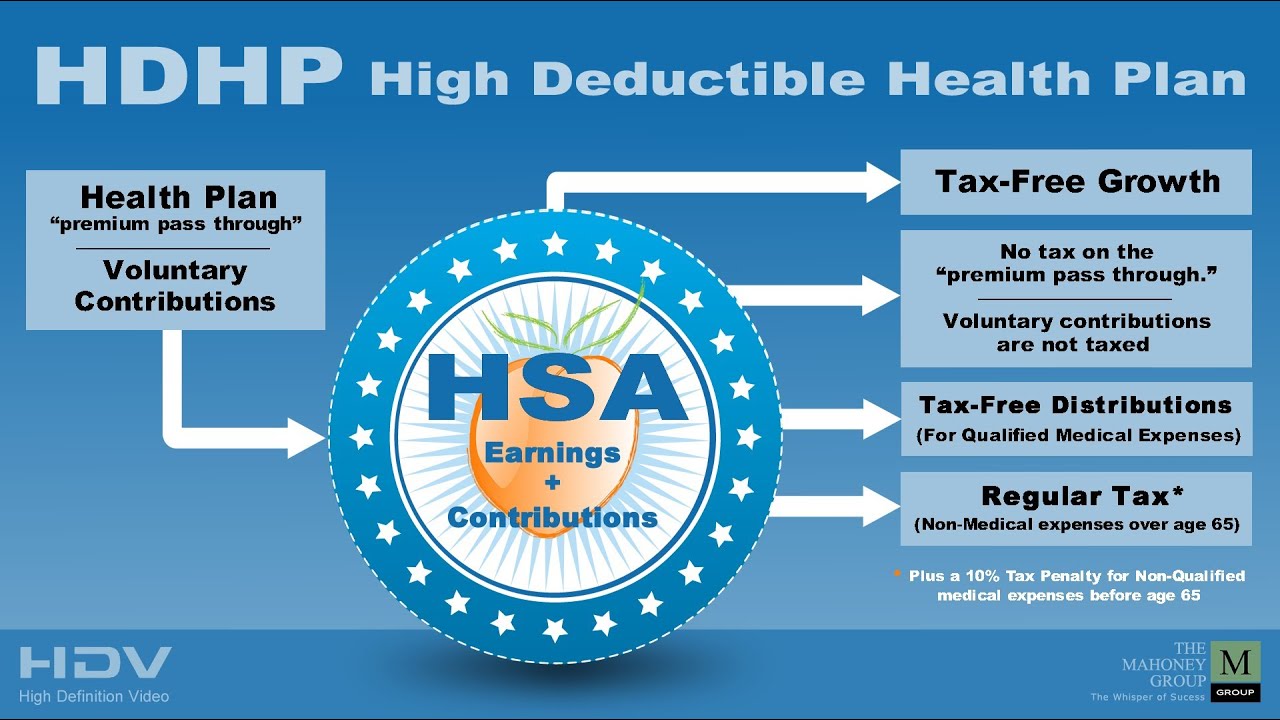

HSAs are designed to complement high-deductible health plans (HDHPs). These plans typically have lower monthly premiums but higher deductibles, meaning you pay more out-of-pocket for healthcare services before insurance coverage kicks in. HSAs allow individuals to save pre-tax dollars specifically for these out-of-pocket medical expenses.

The key to maximizing the benefits of an HSA lies in understanding the eligible expenses. These expenses fall under two broad categories:

1. Qualified Medical Expenses:

These expenses are defined by the IRS and encompass a wide range of healthcare products and services. They include:

- Preventive Care: Routine checkups, screenings, immunizations, and other preventive services.

- Diagnostic Tests: Lab tests, X-rays, ultrasounds, and other diagnostic procedures.

- Treatment and Prescription Drugs: Treatment for illnesses, injuries, and chronic conditions, including prescription medications.

- Durable Medical Equipment: Items like wheelchairs, walkers, canes, and medical supplies.

- Mental Health Services: Therapy, counseling, and psychiatric care.

- Vision Care: Eye exams, eyeglasses, and contact lenses.

- Dental Care: Cleanings, fillings, dentures, and other dental procedures.

- Over-the-Counter (OTC) Medications: While not all OTC medications are HSA-eligible, certain products like pain relievers, allergy medications, and first-aid supplies qualify when prescribed by a physician.

2. Non-Qualified Medical Expenses:

These expenses are not eligible for HSA reimbursement. They include:

- Cosmetic Procedures: Procedures primarily for aesthetic purposes, such as Botox injections or facelifts.

- Weight Loss Programs: Programs not medically necessary for a diagnosed condition.

- Long-Term Care: Services for chronic conditions requiring long-term care, such as assisted living or nursing home care.

- Health Insurance Premiums: Premiums for health insurance, including Medicare and private insurance plans.

- Life Insurance Premiums: Premiums for life insurance policies.

- Over-the-Counter (OTC) Medications: Most OTC medications without a prescription from a physician.

Navigating the Grey Areas:

While the IRS defines eligible expenses broadly, certain situations can raise questions about HSA eligibility. For example:

- Prescription Medications: Some medications are available over the counter (OTC) but are also available by prescription. Generally, HSA eligibility depends on the specific medication and the reason for use. If prescribed by a doctor for a medical condition, the medication is typically eligible.

- Dental Care: While most dental services are HSA-eligible, some procedures, like cosmetic dentistry, may not qualify.

- Vision Care: While eyeglasses and contact lenses are eligible, procedures like LASIK eye surgery may not be.

The Importance of Documentation:

To ensure proper HSA reimbursement, it is crucial to maintain detailed records of all healthcare expenses. This includes:

- Receipts: Keep all receipts for medical products and services.

- Insurance Explanation of Benefits (EOB): Retain EOBs detailing covered and uncovered expenses.

- Prescription Labels: Keep prescription labels with medication name, dosage, and date filled.

- Medical Bills: Maintain copies of medical bills from doctors, hospitals, and other healthcare providers.

Benefits of Utilizing HSA-Eligible Products:

Utilizing HSA-eligible products can significantly enhance the financial benefits of your HSA:

- Tax Advantages: Contributions to an HSA are tax-deductible, reducing your taxable income.

- Tax-Free Growth: Funds in an HSA grow tax-free, allowing for potential compounding.

- Tax-Free Withdrawals: Withdrawals for qualified medical expenses are tax-free.

- Rollover Benefits: Unused funds can be rolled over year after year, providing a long-term savings vehicle.

Tips for Maximizing HSA Utilization:

- Plan for Future Expenses: Consider future medical needs, such as potential surgeries, and allocate funds accordingly.

- Explore HSA-Eligible Products: Research and understand the range of HSA-eligible products and services.

- Consult with a Healthcare Provider: Discuss potential treatments and procedures with your doctor to ensure they are HSA-eligible.

- Track Expenses Carefully: Maintain detailed records of all healthcare expenses for accurate reimbursement.

- Use HSA Funds Wisely: Avoid using HSA funds for non-qualified expenses, as they will be subject to taxes and penalties.

FAQs: Navigating the HSA Landscape:

Q: Can I use my HSA for a cosmetic procedure?

A: No, cosmetic procedures are generally not eligible for HSA reimbursement.

Q: Are over-the-counter (OTC) medications always HSA-eligible?

A: No, most OTC medications are not HSA-eligible unless prescribed by a physician for a specific medical condition.

Q: Can I use my HSA for long-term care?

A: No, long-term care expenses are not eligible for HSA reimbursement.

Q: Can I use my HSA for health insurance premiums?

A: No, health insurance premiums are not eligible for HSA reimbursement.

Q: What happens if I withdraw funds from my HSA for non-qualified expenses?

A: Withdrawals for non-qualified expenses are subject to income taxes and a 20% penalty.

Conclusion:

Understanding the nuances of HSA-eligible healthcare products is crucial for maximizing the benefits of your HSA. By carefully selecting eligible products and services, maintaining detailed records, and utilizing the funds wisely, individuals can leverage the tax advantages and financial security offered by this valuable healthcare savings tool.

Remember, consulting with a healthcare professional and seeking guidance from an HSA administrator can ensure optimal utilization of your HSA and its significant financial benefits.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of HSA-Eligible Healthcare Products: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!