Navigating the World of Cosmetics: A Guide to Harmonized System Codes

Related Articles: Navigating the World of Cosmetics: A Guide to Harmonized System Codes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Cosmetics: A Guide to Harmonized System Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Cosmetics: A Guide to Harmonized System Codes

The global trade in cosmetics is a vast and complex industry, encompassing a wide array of products designed to enhance beauty and personal care. To facilitate efficient and accurate trade, a standardized system of classification is employed: the Harmonized System (HS) code. This article provides a comprehensive guide to understanding HS codes for cosmetics, highlighting their importance and benefits for businesses and consumers alike.

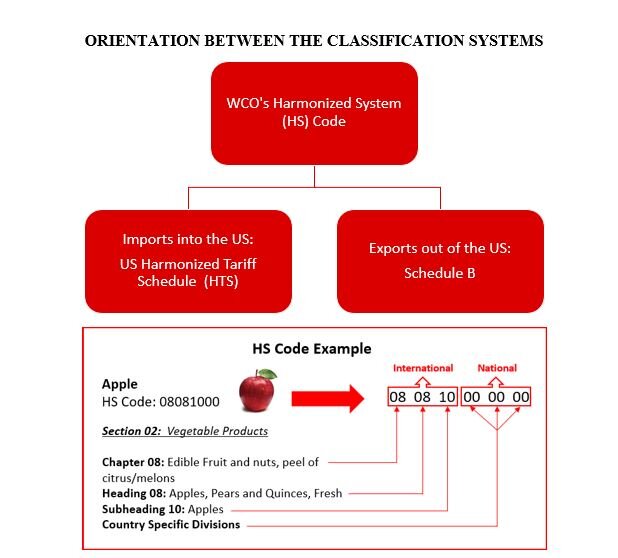

Understanding the Harmonized System (HS) Code

The HS code is a six-digit numerical code used internationally to classify traded goods. It serves as a universal language for customs authorities, facilitating the smooth flow of goods across borders. Within the HS system, cosmetics are categorized under Chapter 33, specifically "Essential oils and resinoids; perfumery, cosmetic or toilet preparations."

Decoding the HS Code for Cosmetics

The six-digit HS code for cosmetics is further subdivided into eight-digit and ten-digit codes, providing increasing specificity. For instance, the HS code 3304.00.00.00 encompasses all "preparations for the hair." This broad category can be further refined by adding two additional digits to specify the type of hair preparation, such as 3304.10.00.00 for "shampoos" or 3304.90.00.00 for "other hair preparations."

The Importance of HS Codes for Cosmetics

Accurate HS code assignment is crucial for various reasons:

- Trade Facilitation: Correct classification ensures smooth customs clearance, minimizing delays and associated costs.

- Tariff Determination: HS codes determine the applicable tariffs or duties imposed on imported goods, impacting pricing and profitability.

- Trade Statistics: HS codes enable the collection of accurate data on trade volumes, facilitating market analysis and policy development.

- Product Safety and Compliance: HS codes can help identify specific ingredients or formulations subject to regulatory restrictions or safety standards.

Navigating the HS Code System for Cosmetics

Understanding the HS code system requires familiarity with the specific categories and subcategories relevant to cosmetics. Several resources can assist in this process:

- World Customs Organization (WCO) Website: The WCO provides the official HS code nomenclature, including detailed descriptions and explanations.

- National Customs Authorities: Each country maintains its own customs website, providing information on local HS code usage and regulations.

- Specialized Trade Databases: Databases like the Harmonized System Nomenclature (HSN) provide searchable directories of HS codes for specific product types.

- Industry Associations: Associations representing the cosmetics industry often offer guidance on HS code classification and relevant regulations.

Frequently Asked Questions (FAQs)

Q: How do I determine the correct HS code for my cosmetic product?

A: Carefully examine the product’s ingredients, intended use, and packaging. Consult the WCO website, national customs authorities, or industry associations for detailed descriptions of HS code categories.

Q: What happens if I misclassify my product’s HS code?

A: Misclassification can result in delays at customs, fines, and even product seizure. It is crucial to ensure accuracy and seek professional assistance if needed.

Q: Are there any specific HS codes for organic or natural cosmetics?

A: While there are no dedicated codes for organic or natural cosmetics, the HS code should reflect the product’s specific ingredients and properties. For example, a product containing certified organic ingredients might be classified under a more specific code reflecting its natural composition.

Q: How do HS codes impact the pricing of cosmetics?

A: HS codes determine the applicable tariffs or duties, which are added to the product’s cost. Higher tariffs can lead to increased prices for consumers.

Tips for Utilizing HS Codes for Cosmetics

- Maintain Accurate Records: Keep detailed records of product ingredients, formulations, and intended uses to support HS code classification.

- Seek Professional Advice: If unsure about the correct HS code, consult a customs broker or trade specialist for assistance.

- Stay Updated on Changes: HS codes are subject to periodic updates and revisions. Stay informed about any changes to ensure accurate classification.

Conclusion

The HS code system plays a vital role in facilitating international trade in cosmetics. Understanding the nuances of HS code classification and utilizing available resources can help businesses navigate the complexities of global trade, ensure compliance with regulations, and optimize their operations. By embracing the HS code system, the cosmetics industry can foster a more efficient, transparent, and sustainable global marketplace.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Cosmetics: A Guide to Harmonized System Codes. We hope you find this article informative and beneficial. See you in our next article!